Checklists seem able to defend anyone, even the experienced against failure in many more tasks than we realized. They provide a kind of cognitive net. They catch mental flaws inherent in all of us-flaws of memory, attention and thoroughness.”

Excerpt from the Book

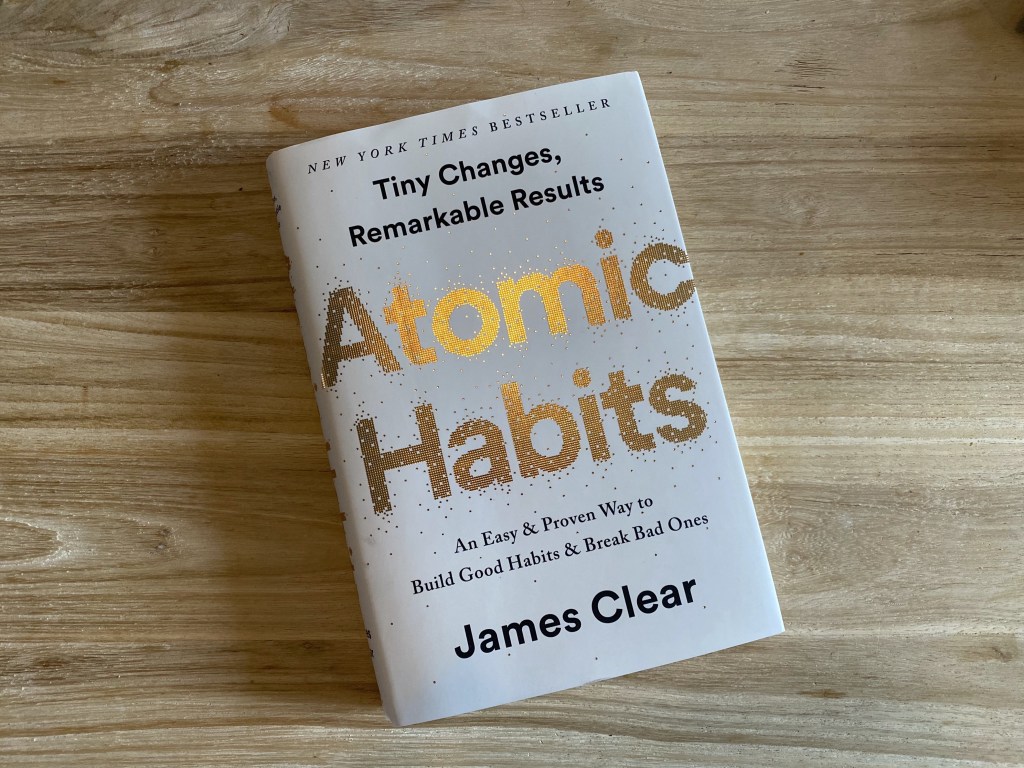

It’s been more than two years since I started making a to-do list every day. And I am still doing it. It not only helped me plan my day but also made me efficient. The question here is whether a simple to-do list would be really helpful in getting things right. The book I am going to discuss says so. In fact, I was a little skeptical, thinking that it’s more than obvious that a to-do list works; why would someone write a book on it? But this book really makes sense by taking the reader through the evolution of checklists.

To err is to be human. We have all heard this multiple times. In fact, it has been estimated that one of the greatest contributors to accidents is human error in any industry. Perrow found that, on average, 60–80 percent of accidents involve human error. Errors in some fields can be overlooked but not every profession can take the risk of even making a tiny error or overlooking the smallest step. Because a small error in the medical field will cost someone their life. In today’s newspaper, I saw this story where a woman was given blood from the wrong group, leading to the deterioration of her health. How grave is this error? There can never be any justification for it. A small error led to the failure of India’s Chandrayan-2 mission, as we all remember.

Do we know how we can make things right? Do we have the capability and capacity to make things right all the time? How do we deal with extreme complexity of the modern world? Why do we make small errors, and how can we avoid them? Is it possible to be 100% accurate?

Atul Gwanade, a professor of surgery at Harvard Medical School, suggests in his book titled ‘The Checklist Manifesto’ the simplest solution anyone can think of. A checklist can help us manage the extreme complexity of the modern world. A detailed checklist acts as protection against the failure of the human mind, memory, and attention. It increases the success rate. According to him, failure results not so much from ignorance (not knowing enough about what works) as from ineptitude (not properly applying what we know works). That’s where a simple checklist comes into picture.

So, the important question we need to ask here is : why should a common person be aware of this method of checklist? It’s because this is not only useful in the medical field but also in other activities that are sometimes mundane and repetitive but also crucial not to be overlooked. The author provides examples of checklist successes in other diverse fields, such as aviation, investment banking, skyscraper construction, and businesses of all kinds.

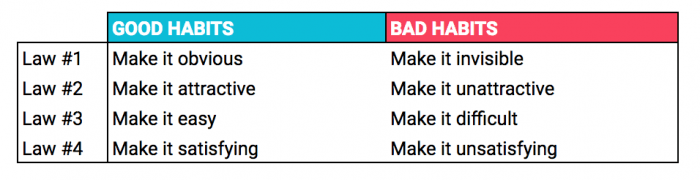

The author differentiates between good and bad checklists too.

The author mentions three characteristics that are part of the code of conduct of any profession, the expectation of selflessness, skill and trust-worthiness along with discipline. Discipline is the hardest to develop because human beings are by nature flawed and inconstant creatures. And checklists can help inculcating discipline in the people, adds Gawande.

In the end, he also urges the users to keep refining these checklists to make them work as per changing circumstances and time.

In an age of unremitting technological complexity, where the most basic steps are too easy to overlook and where overlooking even one step can have irremediable consequences, something as primitive as writing down a to-do list to “get the stupid stuff right” can make a profound difference.

Do you create a checklist for anything in your personal or professional life? If yes, do let me know in the comment box. Also, if you liked reading this post and gained something from it, please buy me a coffee by clicking the link below: